BY CANARY MUGUME

PART 1.

Uganda’s manufacturing sector is facing an unprecedented crisis, with a growing trend of investment flight and corruption driving companies out of the country. The Uganda Manufacturers Association (UMA) has sounded the alarm, warning that the sector’s decline, which began during the COVID-19 pandemic, shows no signs of abating.

According to the The Uganda Business Climate Index of January to March 2021, produced by the Economic Policy Research Centre (EPRC) remained below potential for the fifth consecutive quarter since the first quarter of 2020. The BCI is computed based on the a number of business evaluation indicators: the level of business activity, turnover, profitability, incoming new business, capacity utilisation, average costs of inputs, price of produced goods, business optimism, number of employees, and average monthly salary.

Business for a number of sectors dampened but particularly the index indicates that business in the manufacturing sector further dampened compared to the previous quarter. This was against the backdrop of less favourable business activity, turnover, reduced capacity utilisation, increased inability to establish and expand new business centres. ‘These could have been amplified by the business uncertainty and anxiety due to a post- national election period,’ the report says, but the situation has gotten worse in the past year 2023 as more manufacturers have exited the market and this according to the Uganda Manufactures Association. Why are manufacturers exiting the market and relocating elsewhere?

The cosmetics sector, which manufactures body creams, petroleum jelly, hand lotions, shower gels, and bathing soap, is one of the sectors that has been particularly hit hard. Fred Tumwesigye, Chairperson of the Cosmetics, Personal Care Products Manufacturers Association Uganda, lamented that business has “retarded and diminished” over the past four years due to internal and external factors. He cited bureaucracy and lack of access to incentives as major obstacles, recalling a member’s frustrating experience trying to secure land for a factory.

At the time, the business owner visited a number of offices from the Uganda Investment Authority, Ministry of Trade and the Ministry of Finance, Planning and Economic Development but still didn’t get the land he was promised as an incentive.

This bureaucracy frustrates businesses and lack of access to incentives to manufacturers leads to increase in production costs leaving the business with no profit at all. But there’s another cancer eating up businesses in the manufacturing sector; less favourable business activity. Often not given attention because of how difficult it is to quantify its role in why businesses are closing, corruption is yet another cancer. Government officials often ask for bribes in exchange for favorable treatment such as priority processing, reduced fees, or relaxed regulations.

Dr. Ezra Muhumuza, Executive Director of the UMA, identified corruption as another significant challenge. Government officials often demand bribes in exchange for favorable treatment, such as priority processing, reduced fees, or relaxed regulations. “Certain mandated institutions of government meant to create a favorable environment for businesses to thrive don’t,” Dr. Muhumuza said. “That’s why every investor runs to the President.”

Morrison Rwakakamba, the Board Chairperson Uganda Investment Authority says Investors met the President for many reasons, some of them being; to get the confidence for investment, to show availability and will to invest, or even up to date the president on the projects they are working on. He however admits that there are rogue elements within the investment chain that are asking for kickbacks or frustrating investors. ‘We don’t have a perfect system,’ Morrison adds.

He, however says Uganda investment Authority has automated the system to reduce human contact that yields corruption through the stop center that gives invest access to Uganda National Bureau of Standards (UNBS), Uganda Revenue Authority (URA), Uganda investment Authority (UIA), National Environment Authority (NEMA), among other agencies. Despite this one stop center, investors still find it hard to access incentives to support their businesses.

Dr Chris Baryomunsi, the Minister for information, Communications and Technology says it is possible that there could be some government officials asking for kickbacks, and that can push manufacturers away. ‘But if any government officials are asking for kickbacks and people are keeping quiet then they are not helping us,’ Dr Baryomunsi adds.

Where are manufacturers going?

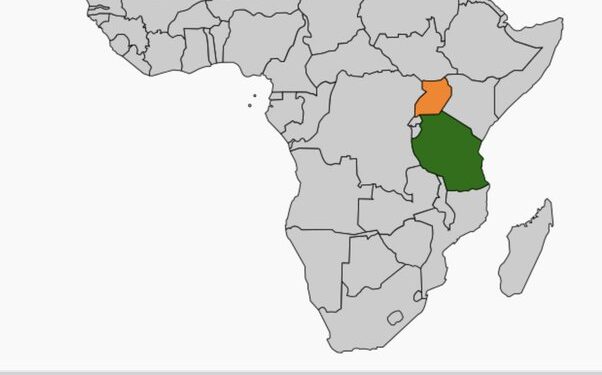

Many manufacturers that have quietly exited the Ugandan market and fled and relocated to Tanzania, which offers a more favorable business environment. Tanzania’s stable and predictable fiscal investment regime, guarantees against nationalization and expropriation, and streamlined bureaucratic processes have attracted investors. In contrast, Uganda’s similar policies are often hindered by poor implementation and corrupt government officials.

Investors in Tanzania are guaranteed against nationalization and expropriation.

Tanzania has found ways on how to deal with bureaucratic processes not to frustrate investors. For example, the investors will be guaranteed to have an Industrial licence within 3 days, a business licence in 1 day, a certificate of incentives in 1 day, resident permit in 7 days. These guarantees by the Government create a soft landing for the investors thus encouraging the growth of their businesses.

Dr Baryomunsi says Uganda being a land locked country puts it as a disadvantage. ‘Tanzania is on the boarder; they have easy and quick transport logistics system so that’s why commercial dealings are thriving. Its proximity to the sea is an added advantage and Uganda is a land locked country,’ Dr Baryomunsi argues.

UIA’s Morrison insists that beyond just peace and security which have given investors reassurances of safety of their capital, Uganda has the best incentives regime that span over 10 years. ‘We have processed so many mortgages for many investors, there are so many companies that have accessed loans at a dollar rate of 8% and 12% for the Uganda Shilling,’ Morrison argues.

This story was done with the support from Action Aid International Uganda